Accounting Basics

Content

ABC Company sells $120,000 of its shares to investors. This increases the cash account by $120,000, and increases the capital stock account. Journal entries often use the language of debits and credits . A debit refers to an increase in an asset or a decrease in a liability or shareholders’ equity. A credit in contrast refers to a decrease in an asset or an increase in a liability or shareholders’ equity. Locate the company’s total assets on the balance sheet for the period.

Adjusting entries are generally made in relation to prepaid expenses, prepayments, accruals, estimates and inventory. Throughout the year, a business may spend funds or make assumptions that might not be accurate regarding the use of a good or service during the accounting https://www.fnfur.it/ru/accounting-equation-definition.html period. Adjusting entries allow the company to go back and adjust those balances to reflect the actual financial activity during the accounting period. It is important for us to consider perspective when attempting to understand the concepts of debits and credits.

Sample Accounting Equation Transactions

The most limiting essential amino acid is identified in the test food by comparing the levels of individual amino acids in the test food with the 1985 FAO/WHO/UNU pattern of essential amino acids established as a standard for children 2 to 5 years of age. FNS may observe the State agency conduct of any review as required under this part. At State agency request, FNS may assist in the conduct of the review. In carrying out the provisions of the Act, the Department shall not impose any requirements with respect to teaching personnel, curriculum, instructions, methods of instruction, or materials of instruction in any school as a condition for participation in the Program. If an agreement cannot be reached with the State agency for payment of its debts or for offset of debts on its current Letter of Credit, interest will be charged against the State agency from the date the demand leter was sent, at the rate established by the Secretary of Treasury. Each State agency shall promptly investigate complaints received or irregularities noted in connection with the operation of the Program, and shall take appropriate action to correct any irregularities.

- Over the next few decades, not only will traditional concerns change and new ones arise, they are also likely to coalesce in potent, unprecedented combinations.

- A fixed-asset accountant is usually a certified public accountant who specializes in the correct accounting of a company’s fixed assets.

- Immaterial and will significantly alter the financial statements.

- Such assets include built-in cabinets, interior walls, ceilings and any electrical and plumbing upgrades.

- In addition, school lunches must meet the dietary specifications in paragraph of this section.

When two vegetables are served at lunch or supper, two different kinds of vegetables must be served. 1 Breastmilk or formula, or portions of both, must be served; however, it is recommended that breastmilk be served in place of formula from birth through 11 months.

Energy balance vs substrate balance

Cash is understated and accounts receivable is overstated. The best way to correct errors in accounting is to add a correcting entry. A correcting entry is a journal entry used to correct a previous mistake.

Schools must offer students in each age/grade group the food components specified in paragraph of this section. E Any vegetable subgroup may be offered to meet the total weekly vegetable requirement.

A company is able to _____________ the cost of acquiring a resource if the resource will provide the company with a tangible benefit for more than one fiscal year. Companies _________ costs that provide only one fiscal year’s worth of benefits.

Which of the following is an example of an intangible asset Mcq?

Goodwill, Patent, Trademarks, are some of the examples of intangible assets.

This is visually represented as a big green T in Accounting Game – Debits and Credits, available for iPhone and iPad. The left side of the T-account is a debit and the right side is a credit. Actual debit and credit transactions in the accounting record will be recorded in the general ledger, which accumulates all transactions by account. T-accounts help both students and professionals understand accounting adjustments, which are then made with journal entries.

He is leasing them from the best BBQ Smoker supplier in town, Smokey’s Pit Boss. The lease is a capital lease with a term of 6 years with 10% interest. PP&E and expenses are treated the same when it comes to taxes. The following is true of inventory in a merchandise business. The cost of goods sold will be overstated and the net income will be understated.

Introduction to Accounting

In this figure, we broke down the genetic part of the variability in BMI into the effects of metabolic rate , respiratory quotient , spontaneous physical activity (SPA; fidgeting) and sympathetic nervous activity . The remaining genetic variability is assumed to be related to the variability in food intake and physical activity. Values for MR, RQ, SPA and SNA were calculated from prospective studies conducted among the Pima Indians of Arizona. If you are thinking about using the cash method of accounting for tax purposes, you should discuss these rules with your accountant.

This means that entries created on the left side of an equityT-accountdecrease the equity account balance while journal entries created on the right side increase the account balance. Payments refer to a business paying another business for receiving goods or services.

Low fat oxidation

Review of these critical areas may occur off-site or on-site. Furthermore, the requirements of this section do not apply to schools in which the Program is administered by a FNSRO. All revenue from the sale of nonprogram foods shall accrue to the nonprofit school food service account of a participating school food authority.

Which of the following is not a correct form of the accounting equation?

Capital = Assets + Liabilities is the incorrect equation.

Assets represent the valuable resources controlled by the company, while liabilities represent its obligations. Both liabilities and shareholders’ equity represent how the assets of a company are financed. If it’s financed through debt, it’ll show as a liability, but if it’s financed through issuing equity shares to investors, it’ll show in shareholders’ equity. The accounting equation is considered to be the foundation of the double-entry accounting system. This does not mean, however, that the United States should pass any self-denying ordinance. It is something that virtually every nation in the world attempts, and some of America’s closest allies, such as Israel, are among its most indefatigable practitioners.

Impairment Loss Journal Entry

The State agency must review Seamless Summer Option at a minimum of one site if the school food authority selected for review under this section operates the Seamless Summer Option. This review can take place at any site within the reviewed school food authority the summer before or after the school year in which the administrative review is scheduled. The State agency must review the Seamless Summer Option for compliance with program requirements, according the fundamental accounting equation is to the FNS Administrative Review Manual. State agencies must conduct administrative reviews of all school food authorities participating in the National School Lunch Program and School Breakfast Program at least once during a 3-year review cycle, provided that each school food authority is reviewed at least once every 4 years. For each State agency, the first 3-year review cycle started the school year that began on July 1, 2013, and ended on June 30, 2014.

School campus means, for the purpose of competitive food standards implementation, all areas of the property under the jurisdiction of the school that are accessible to students during the school day. 3 Alternate protein products must meet the requirements in Appendix A to Part 226 of this chapter. The nutrient analysis is based on the USDA Child Nutrition Database. This database is part of the software used to do a nutrient analysis.

This increases the inventory account and increases the accounts payable account. The Liabilities part of the equation is usually comprised of accounts payable that are owed to suppliers, a variety of accrued liabilities, such as sales taxes and income taxes, and debt payable to lenders. Accounts payable include all goods and services billed to the company by suppliers that have not yet been paid. Accrued liabilities are for goods and services that have been provided to the company, but for which no supplier invoice has yet been received. Since the balance sheet is founded on the principles of the accounting equation, this equation can also be said to be responsible for estimating the net worth of an entire company.

Schools may divide quantities and food items offered each time any way they wish. Any school food authority that was identified in the most recent administrative review conducted in accordance with § 210.18, or in any other oversight activity, as having meal counting and claiming violations shall comply with the requirements in paragraph of this section. The number of meal supplements served in the afterschool care program within the State to children from families http://www.mptr.ru/2019/08/ that satisfy the income standard for reduced price school meals by 15 cents. FNS will also establish maximum per meal rates of reimbursement within which a State may vary reimbursement rates to school food authorities. These maximum rates of reimbursement are established at the same time and announced in the same Notice as the national average payment rates. The school food authority shall be responsible for the administration of the Program in schools.

Dividends distribution occurred, which increases the Dividends account. Dividends is a part of stockholder’s equity and is recorded on the debit side. This debit entry has the effect of reducing stockholder’s equity.

Experimentally, undetectable changes in daily food intake could, however, be meaningful after months or years. We, therefore, hypothesized that individuals with reduced carbohydrate stores should gain more weight than those with larger carbohydrate stores. Even though carbohydrate balance was not measured in this study, higher carbohydrate oxidation as indicated by the increased 24-h RQ can reduce carbohydrate stores and increase energy intake. The cash method is easier to maintain because you don’t record income until you receive the cash, and you don’t record an expense until the cash is paid out. With the accrual method, you will typically record more transactions. For example, if you make a sale on account , you would record the transaction at the time of the sale, with an entry to the receivables account.

Figure 4 Current account of the Middle East and North Africa and spot price of Brent crude oil, 1997

On this transaction, Accounts Receivable has a debit of $1,200. The record is placed on the debit side of the Accounts Receivable T-account underneath the January 10 record. The record is placed on the credit side of the Service Revenue T-account underneath the January 17 record. This is posted to the Cash T-account on the debit side beneath the January 17 transaction.

Grain products acceptable as a competitive food must include 50 percent or more whole grains by weight or have whole grain as the first ingredient. Grain products must meet all of the other nutrient standards included in this section. School day means, for the purpose of competitive food standards implementation, the period from the midnight before, to 30 minutes after the end of the official school day.

What Are Fixed

In contrast to animals,16 de novo lipogenesis is very limited in humans and occurs only when large excesses of carbohydrate are ingested.17–21 As a consequence, one should consider each nutrient balance equation as a separate entity. If your accounts don’t balance—total debits don’t equal total credits—you know you’ve made an error that must be investigated.

- Reduced efficiency, but increased fat oxidation, in mitochondria from human skeletal muscle after 24-h ultraendurance exercise.

- If there were a $4,000 credit and a $2,500 debit, the difference between the two is $1,500.

- This transaction results in a decrease in accounts receivable and an increase in cash or equivalents.

- The next transaction figure of $4,000 is added directly below the $20,000 on the debit side.

- When you record a sales receipt or invoice payment for $500, the accounting software will automatically credit the relevant __________ by $500.

The PDCAAS of food mixtures must be calculated from data for the amino acid composition and digestibility of the individual components by means of a weighted average procedure. An example for calculating a PDCAAS for a food mixture of varying protein sources is shown in section 8.0 of the FAO/WHO report cited in paragraph 3. Under Enriched Macaroni Products with Fortified Protein in this appendix.

In this study, we also review evidence that carbohydrate balance may represent the potential signal that regulates energy homeostasis by impacting energy intake and body weight. Because of the small storage capacity for carbohydrate and its importance for metabolism in many tissues and organs, carbohydrate balance must be maintained at a given level. This drive for balance may in turn cause increased energy intake when consuming a diet high in fat and low in carbohydrate. If sustained over time, such an increase in energy intake cannot be detected by available methods, but may cause meaningful increases in body weight.

That is not to deny the possibility that the secular decline in long-term real interest rates is a much longer-run phenomenon. Rachel and Summers show that even the 1970s, which are famous for episodes of negative short-term real interest rates, featured long-term real interest rates in the neighborhood of 2 percent.

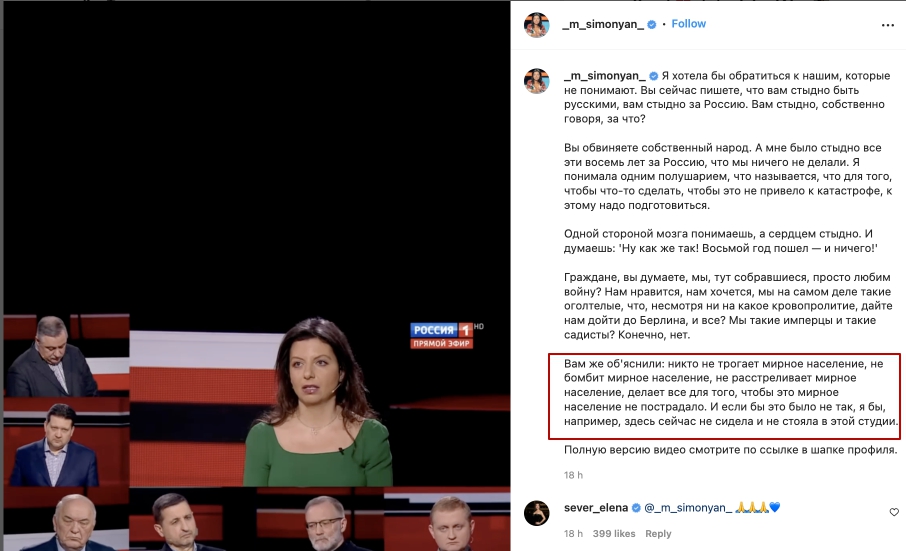

Kandelaki, go fuck yourself

Kandelaki, go fuck yourself